- Balance Sheet

- Posts

- 📈 iFold ?

📈 iFold ?

Apple’s foldable iPad ambitions are making waves. Meanwhile, McKinsey is paying $650 million for its role in the opioid crisis, and Twitter’s decline shows no signs of slowing. Big bets and bigger consequences define this week’s headlines.

Here’s what you missed while you were living you were unplugged:

🧠 Mark Cuban says AI won’t replace critical thinking. The billionaire investor believes AI’s impact on white-collar work will be limited, especially in roles that require creativity and problem-solving. He argues that the real disruption will target repetitive, lower-skill jobs.

💊 McKinsey agrees to $650M settlement in opioid case. The consulting giant will pay $650 million to resolve allegations related to its advice to Purdue Pharma on marketing painkillers. This marks one of the largest settlements tied to the U.S. opioid epidemic.

☕ India’s Tata faces Starbucks slowdown. Economic pressures are causing a lattè headaches for Starbucks’ joint venture with Tata in India as consumers scale back on luxury coffee purchases. The company is under pressure to adapt its strategy as spending dips in one of its key growth markets.

Featured weekend story

Apple’s Foldable iPad: A Chance at Redemption

Apple is reportedly developing a foldable iPad, an ambitious move after a tough year. Following the Vision Pro’s lackluster launch—marked by slow sales, user complaints, and scaled-back production—Apple is searching for its next big hit. Rumors suggest the foldable iPad could feature a seamless, crease-free design and the ability to run macOS apps, blending portability with professional-grade functionality.

With rivals like Samsung and Huawei already dominating the foldable device market, Apple faces intense pressure to deliver. The foldable iPad could help redefine its lineup and win back consumers eager for something groundbreaking.

But don’t expect this device anytime soon. Analysts suggest the foldable iPad might not launch until 2028, giving Apple time to perfect the product—or risk missing its moment altogether.

What to watch this week

▲ | Nasdaq | $19,859.77 | +.81% |

▲ | S&P | $6,090.27 | +.25% |

▼ | Dow | $44,642.52 | -.28% |

▲ | 10-Year | 4.4% | +0.01 |

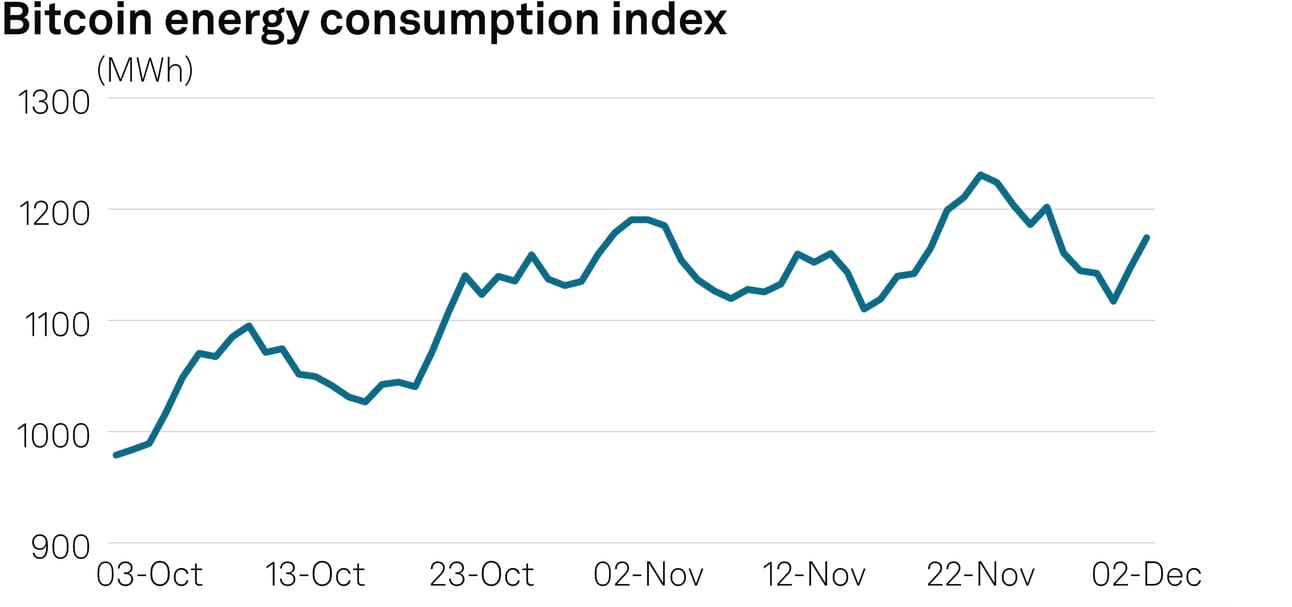

▲ | Bitcoin | $106,000.00 | +2% |

▲ | Oil | $71.29 | +6.10% |

▲ | Apple | $243.04 | +.00004% |

Indices at 12:00 AM (ET)

Here are your upcoming market events:

💵 Fed Signals Patience on Rate Cuts

The Federal Reserve is signaling a slower pace of rate cuts in 2025, citing persistent inflation that remains stuck above its 2% target. With policymakers hesitant to ease too quickly, businesses and consumers could face prolonged higher borrowing costs, potentially dampening growth and delaying recovery efforts.🎠 Disneyland’s $233M Wage Theft Settlement Turns Heads

Disneyland is shelling out $233 million in California’s largest-ever wage theft case after allegations of unpaid wages to park employees. The payout isn’t just a financial blow—it’s a wake-up call for labor practices in an industry that prides itself on delivering magic to consumers.🔥 Hedge Funds Double Down on Europe’s Energy Play

Hedge funds are making big bets on European equities, with energy and natural gas sectors at the forefront. Attracted by low valuations and an anticipated recovery in energy demand, investors are targeting opportunities in countries like Germany and Norway. This surge of interest comes as Europe stabilizes from energy crises.

Off-balance sheet items

Here’s what we’re reading this week:

Twitter's Traffic Trouble. Twitter’s web traffic is plummeting as platforms like Bluesky gain traction, raising questions about the platform’s future under Elon Musk

Bob Dylan’s $7.25M Hideout Hits the Market. The singer’s former Greenwich Village home is up for sale, just as anticipation builds for Timothée Chalamet’s Dylan biopic.

UK’s Vape Waste Crisis. Over a million disposable vapes are discarded daily in the UK, sparking urgent calls to address the growing e-waste problem.

The bottom line

Aquire new customers and drive revenue by partnering with us.

Balance Sheet is rapidly growing, with 1,500+ readers working in the world’s leading organizations. You can learn more about partnering with us here.